From Startup to Successful Exit: Sales Insights from Sales OStin

From Startup to Successful Exit: Sales Insights from Sales OStin

The event “Sales OStin: From Startup to Successful Exit”, thoughtfully organized by Lucy Yaromenko and Val Yaromenko, owners of Big Sister AI, brought together two industry veterans — Michael Tessler (BroadSoft, True North Advisory) and Gordon Daugherty (Capital Factory, M&A expert) — for a deep dive into the full entrepreneurial journey, from building a sustainable company to achieving a successful IPO or acquisition.

The conversation explored how founders can create lasting value by focusing on strong execution, market positioning, and governance, while also navigating the complexities of mergers and acquisitions. Packed with practical insights and real-world lessons, the discussion offered a roadmap for startup leaders aiming to scale, attract investors, and ultimately, exit on their own terms.

Michael Tessler: Visionary Leader Behind BroadSoft and True North Advisory

Michael Tessler is a seasoned technology pioneer and entrepreneur, best known as the co-founder and former CEO of BroadSoft. Under his leadership, BroadSoft became the global leader in cloud communications, growing to nearly 2,000 employees with clients across 80 countries, before being acquired by Cisco in 2018.

After helping integrate BroadSoft into Cisco’s Webex portfolio, Tessler co-founded True North Advisory, focusing on assisting entrepreneurs to scale businesses in customer experience and technology. His extensive experience includes guiding companies through transformational market shifts and preparing them for IPO readiness.

Michael shared a key perspective on today’s sales challenges:

“Today, I would say that a lot of the companies I work with, building the product is not as hard as it was back then, actually, sales and marketing are so much harder. Getting the attention of customers... really, really difficult.”

This quote highlights the reality for modern startups: developing an excellent product is often easier than cutting through noise to win customers. Execution in sales and marketing demands far greater focus and discipline.

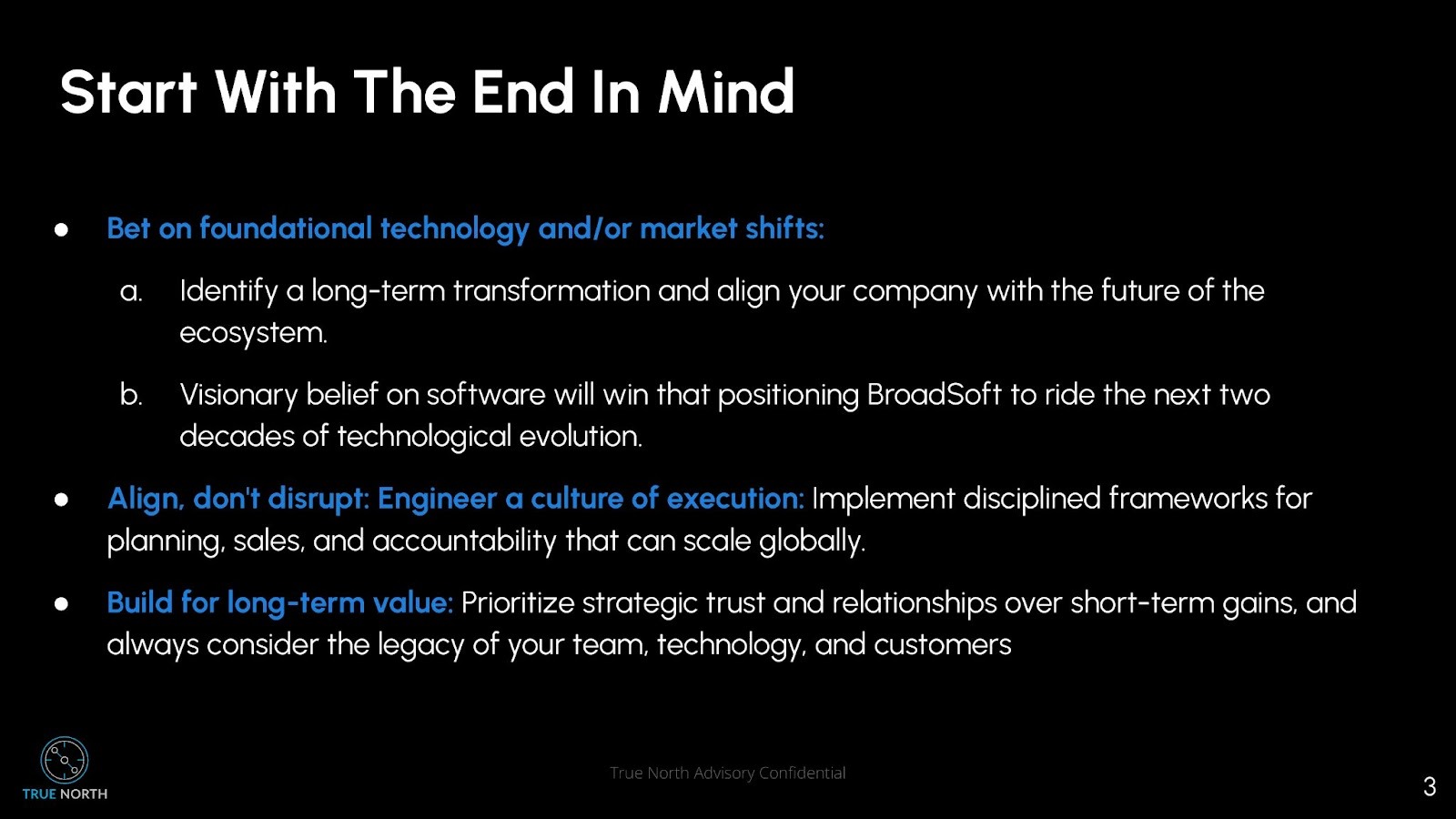

This slide highlights the importance of long-term strategic thinking when building a company.

From a practical business view:

- Bet on foundational shifts — focus on technologies and market trends that will define the next decade, not just the next quarter.

- Align, don’t disrupt — create a disciplined, execution-driven culture that scales globally through clear planning and accountability.

- Build for long-term value — prioritize trust, relationships, and sustainable growth over short-term wins, ensuring your company’s lasting impact.

Main insight: Success comes from aligning with future market direction, executing with consistency, and thinking beyond immediate results.

Key Takeaways from Michael Tessler:

- Build First, Don’t Start with an Exit: Exiting (IPO or acquisition) is an event, not a strategy. Prioritize creating sustainable business value.

- Bet on Transformational Markets: Target foundational technological shifts that offer large market opportunities to attract major investors.

- Master Go-to-Market (GTM): Building a scalable GTM sales model is increasingly critical and often more challenging than product development.

- Leverage Partner Ecosystems: Partner-centric sales channels reduce costly direct selling and build defensible market moats.

- Execution is the Hard Part: Ideas are easy; disciplined, consistent execution drives growth.

- Use Case Selling Matters: Communicate clearly how the technology will solve real problems for customers.

- Annual Intense Strategy Review: A yearly "rip the business down" review with leaders helps refine focus and growth levers.

- Early Governance & Culture: Cultivate accountability, transparency, and clean financials early to build investor confidence.

- Advisory Board with Impact: Recruit high-quality boards with real responsibilities to support governance and strategy.

Michael further underscored the importance of trusting sales teams and embracing sales-led growth, saying:

“My personal thought is, you really need to let the sales organization be a trusted sales organization... most things have to be sold.”

This speaks to the need to empower sales teams as key drivers of growth rather than relying solely on product-led approaches.

Practical Implications for Your Business:

Focus intense energy on building a reliable, repeatable sales system with use-case-driven messaging that resonates with buyers. Establish governance and culture foundations early to avoid pitfalls in scaling and fundraising. Annual strategic reviews ensure teams stay aligned with prioritized goals.

Conclusion on Michael Tessler’s Insights:

Michael’s experience as a tech pioneer reveals that successful company building demands far more than great products. It requires relentless execution in sales, disciplined governance, and strategic partnership building. This approach lays the groundwork for a successful exit when the time comes.

Gordon Daugherty: Expert M&A Strategist and Capital Factory Veteran

Gordon Daugherty, a veteran of Capital Factory, is an M&A expert whose experience is uniquely rich: he has been personally involved in 16 company acquisitions, acting 11 times as the buyer and 5 times as the seller. This dual perspective allows him to bring an especially insightful and pragmatic view of navigating company exits. His expertise lies in helping startups understand their leverage in negotiations, strategically position themselves for the highest valuation, and anticipate the counterparty's strategy.

Gordon explained the crucial difference in negotiating power based on whether a company is “selling” or is being “bought”:

“If your prospective acquirer desperately needs and must have what you have, it’s a massive difference. That would be on the far right end of the spectrum of favorable situations. On the far left is that of a fire sale... and you have to sell the company to extract some value, maybe.”

This analogy is fundamental. Companies in strong positions can dictate terms, while those desperate for cash often lose leverage.

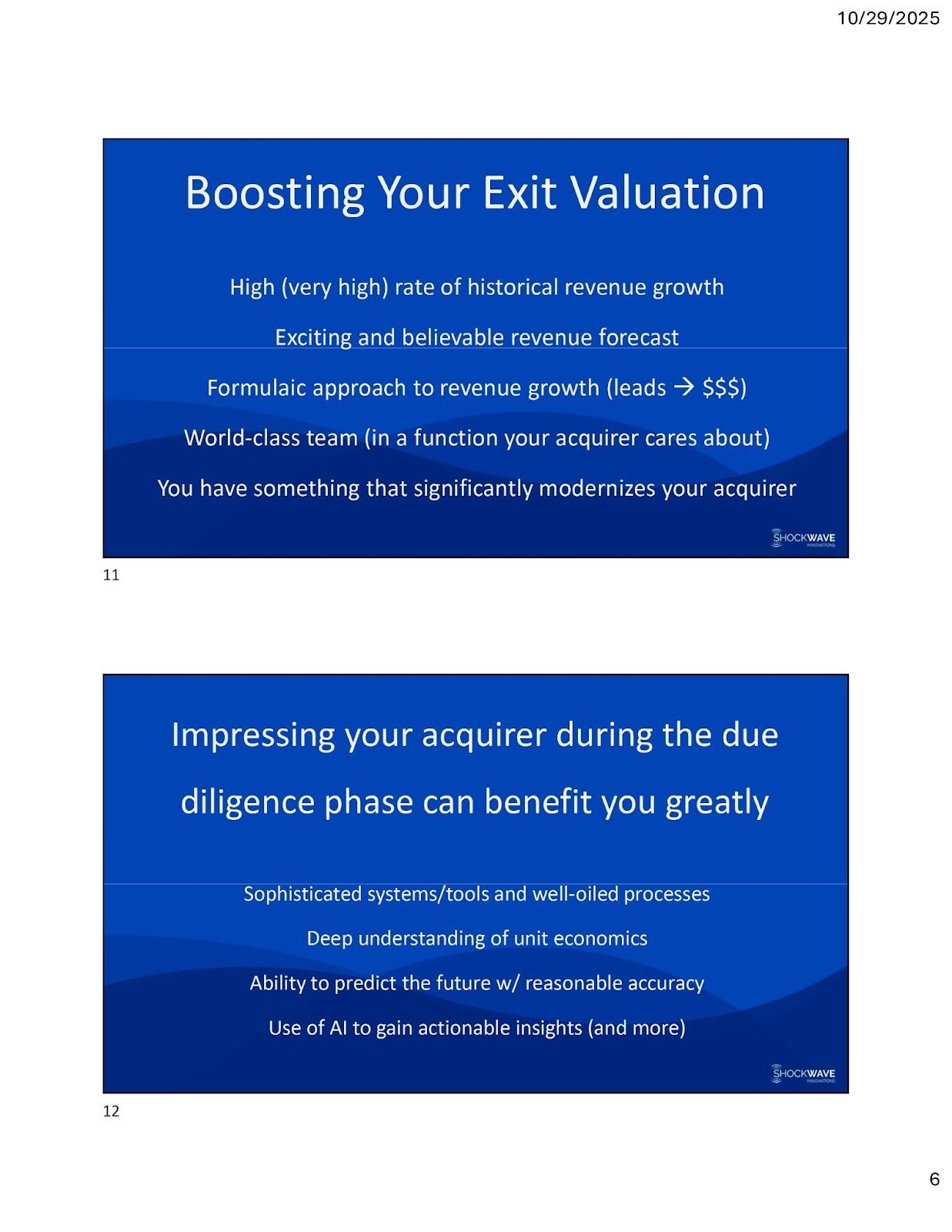

These slides show how to raise your company’s value before an acquisition and impress buyers during due diligence.

To boost valuation, show strong and predictable revenue growth, a credible forecast, a capable team, and technology that modernizes the acquirer.

During due diligence, demonstrate operational excellence — reliable systems, clear unit economics, accurate forecasting, and smart use of AI.

Bottom line: Prove growth and efficiency to appear low-risk and high-value to acquirers.

Key Takeaways from Gordon Daugherty:

- Assess Negotiation Position: Determine if you are in control (buyer needs you) or desperate (fire sale).

- Don’t Appear Desperate: Maintain your mission to build value; avoid signaling urgency to sell.

- Control Information Flow: In early phases before a signed LOI, share only essential data (high-level financials, demos). Avoid releasing roadmaps or detailed budgets prematurely.

- Valuation Reflects Synergies: Exit price is driven by what the acquirer can achieve using your product and team, combined with their resources.

- Boost Valuation with Growth & Predictability: Demonstrate strong historical growth and believable revenue projections.

- Treat Due Diligence as Negotiation: Use professionalism, speed, and organization during DD to offset risk factors.

- Ask Strategic Questions: Help acquirers justify high valuations by understanding how you fit into their plans.

- Hire Specialized Advisors: Engage M&A-specific attorneys and trusted board members to guide negotiations and avoid costly mistakes.

Gordon’s call to action is clear:

“There are things that you could do now or should stop doing right now that could make a dramatic difference in your future acquisition exit.”

This stresses the importance of early and ongoing preparation around governance, IP, and legal hygiene.

Practical Impact for Business Leaders:

Begin governance and cleanup early — even well before an exit is planned — to avoid last-minute fire drills. Manage the flow of sensitive information carefully to preserve negotiation leverage. Selecting experienced advisors can significantly influence deal terms and successful closing.

Conclusion on Gordon Daugherty’s Guidance:

Gordon’s expertise illuminates the importance of preparation, control, and discipline in M&A exits. Viewing due diligence as an ongoing negotiation and strategically positioning your company as a must-have acquisition target maximizes exit value.

Closing Thoughts: Sales and Building for Exit Success

The Sales OStin event delivered actionable insights for founders and sales leaders ready to scale and position their companies for long-term success. Michael Tessler and Gordon Daugherty’s combined experience offered not just theory, but a practical roadmap — from building a predictable sales engine and leveraging partnerships to maintaining clean governance and mastering the art of negotiation.

The key takeaway: focus relentlessly on execution, market understanding, and readiness for future opportunities, whether they lead to an IPO or acquisition.

We look forward to seeing you at the next Sales OStin events, where we’ll continue exploring the strategies that turn startups into standout success stories.